50 фото. Теракт 11 сентября - Судный день США

Десять лет назад, 19 мужчин, обученных аль-Каидой проводят скоординированные террористические атаки на США, что планировалось в течение многих лет. Нападавшие угнали одновременно четыре больших пассажирских самолета с целью врезаться ними в главные точки Соединенных Штатов, нанося столько смертей и разрушений, насколько это возможно. Три самолета поразили свои цели, четвертый упал в поле в Пенсильвании. За один день, эти преднамеренные акты массового убийства унесли жизни почти 3000 человек из 57 стран. Более 400 из погибших были первыми ответчиками, в том числе пожарники в Нью-Йорке и полицейские. Это было одно из самых широко освещаемых СМИ событий всех времен, и десятилетие спустя, фотографии все еще вызывают массу эмоций. Эти атаки и всеобщая реакция на них глубоко изменили образ мира, в котором мы живем, так что является важным, чтобы просмотреть эти фотографии, и запомнить то, что случилось в тот черный день. Эта фотохроника второй части серии из трех частей на 10-ую годовщину трагедии в США 11 сентября 2001.

Это фото с камеры наблюдения Пентагона показывает огненный шар, вспыхнувший в результате, когда угнанный аэробус рейса 77 American Airlines, с 58 пассажирами и 6 членами экипажа на борту, врезался в Пентагон 11 сентября 2001 года.

Пламя и дым валят из здания Пентагона.

Обираємо ідеальну жіночу білизну: найкращі моделі та стилі для кожної жінки від магазину LONDI

Обираємо ідеальну жіночу білизну: найкращі моделі та стилі для кожної жінки від магазину LONDI Обеспечение безопасности: эффективные методы охраны квартир

Обеспечение безопасности: эффективные методы охраны квартир Дроны атаковали предприятия в российском Татарстане

Дроны атаковали предприятия в российском Татарстане

11 сентября 2001 в США - голливудский триллер засекреченной реальности

11 сентября 2001 в США - голливудский триллер засекреченной реальности Крупный теракт в Ницце: на Английской набережной убиты 84 человека

Крупный теракт в Ницце: на Английской набережной убиты 84 человека Интригующие фото таинственных исследователей тоннелей метро в Нью-Йорке

Интригующие фото таинственных исследователей тоннелей метро в Нью-Йорке 1Win играть в онлайн слоты на деньги

1Win играть в онлайн слоты на деньги Путин: "Россию никто не слушал. Послушайте сейчас" - реакция мира на новое оружие

Путин: "Россию никто не слушал. Послушайте сейчас" - реакция мира на новое оружие Онлайн казино Белоруссии: обзоры Алексея Иванова

Онлайн казино Белоруссии: обзоры Алексея Иванова Последствия неверно понятого бюллетеня о судьбе страны. СССР версии 2.0

Последствия неверно понятого бюллетеня о судьбе страны. СССР версии 2.0 Самые громкие поражения в истории хоккея

Самые громкие поражения в истории хоккея ТОП 7 жилых комплексов в пригороде Киева со сдачей до 2024 год

ТОП 7 жилых комплексов в пригороде Киева со сдачей до 2024 год Немцы в ужасе: русские экономят на продуктах питания и берут кредиты!

Немцы в ужасе: русские экономят на продуктах питания и берут кредиты! Фотоинспекция. А какие вещи берут с собой в роддом русские женщины?

Фотоинспекция. А какие вещи берут с собой в роддом русские женщины? Пост отчаяния из Львова: народ имеет таких правителей, которых заслуживает!

Пост отчаяния из Львова: народ имеет таких правителей, которых заслуживает! Что нужно знать о букмекере Вбет регистрация и официальный сайт

Что нужно знать о букмекере Вбет регистрация и официальный сайт Сравните 70 лет спустя. Города России - военные кадры и снимки современные

Сравните 70 лет спустя. Города России - военные кадры и снимки современные Факты. Смогут ли русские новейшим оружием победить американскую армию?

Факты. Смогут ли русские новейшим оружием победить американскую армию?

Глобальная слежка в Windows 10: как запретить сбор данных?

Глобальная слежка в Windows 10: как запретить сбор данных? Проблемы экологии. Покажите фильм «Дом. История путешествия» всем людям!

Проблемы экологии. Покажите фильм «Дом. История путешествия» всем людям! Заставим Windows 10 прекратить нарушать приватность пользователей!

Заставим Windows 10 прекратить нарушать приватность пользователей! Долг платежом красен! Кому же США должны рекордные 20 трлн долларов?

Долг платежом красен! Кому же США должны рекордные 20 трлн долларов? Сравниваем! Обсуждение почасовой минимальной зарплаты в разных странах

Сравниваем! Обсуждение почасовой минимальной зарплаты в разных странах Редкие таинственные дикие кошки. Вы даже не знали о существовании таких!

Редкие таинственные дикие кошки. Вы даже не знали о существовании таких! Спящие мужья - ведь шоппинг для жены может продолжаться вечность

Спящие мужья - ведь шоппинг для жены может продолжаться вечность Словно живые: цветные фото советских героев Великой Отечественной войны

Словно живые: цветные фото советских героев Великой Отечественной войны Рецепт морских гребешков с фуа-гра, ягодами и острым медовым соусом

Рецепт морских гребешков с фуа-гра, ягодами и острым медовым соусом Продукты под запретом на один год: что же исчезнет с российских прилавков?

Продукты под запретом на один год: что же исчезнет с российских прилавков? Приготовь! Шоколадные рецепты: вкуснейший торт «Прага»

Приготовь! Шоколадные рецепты: вкуснейший торт «Прага» Здоровая еда: полезные для человека растительные масла

Здоровая еда: полезные для человека растительные масла Пальмовое масло не является отравой, которой нас пичкают производители

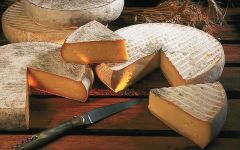

Пальмовое масло не является отравой, которой нас пичкают производители Несколько интересных фактов о сыре. В фотографиях

Несколько интересных фактов о сыре. В фотографиях Рецепты с фото: салат из чечевицы с помидорами черри

Рецепты с фото: салат из чечевицы с помидорами черри