25 лучших фотографий National Geographic. Часть 1

Часть 1. Лучшие высококачественные фотографии флоры и фауны от National Geographic.

Гиппопотамы, Танзания.

Fly Geyser, штат Невада, США.

Птица-пчелоед в полете.

Озеро Луны, Индия.

Кит.

Атлантический морж, Канада.

Рыба-лев.

Дельфины афалины на волнах.

Лев, ЮАР.

Отражение фламинго.

Листья лилии, Венецианские сады, Флорида.

Купание слонов, Индия.

Шотландская корова.

Детеныши медведя гризли.

Розовая орхидея.

Северная пятнистая сова.

Ель ночью, Финляндия.

Манты, залив Ханифару на Мальдивских островах.

Исследователь пещер, Теннесси.

Орхидея Король Паук.

Рифовая акула, Мальдивы.

Синеязыкая ящерица, Австралия.

Чайка и лодки.

Кайман и черепахи, Гватемала.

Рот рыбы-попугай, Большой Барьерный риф.

Обираємо ідеальну жіночу білизну: найкращі моделі та стилі для кожної жінки від магазину LONDI

Обираємо ідеальну жіночу білизну: найкращі моделі та стилі для кожної жінки від магазину LONDI Обеспечение безопасности: эффективные методы охраны квартир

Обеспечение безопасности: эффективные методы охраны квартир Дроны атаковали предприятия в российском Татарстане

Дроны атаковали предприятия в российском Татарстане

30 лучших рейтинговых фотографий National Geographic

30 лучших рейтинговых фотографий National Geographic Фотоконкурс National Geographic 2015: лучшие фото от путешественников

Фотоконкурс National Geographic 2015: лучшие фото от путешественников Дикие и домашние животные в новостях

Дикие и домашние животные в новостях 42 фото. Топ 10: Самые сообразительные животные. Часть 2

42 фото. Топ 10: Самые сообразительные животные. Часть 2 Наша планета прекрасна: рейтинг самых красивых озер

Наша планета прекрасна: рейтинг самых красивых озер Погибший Танкред Меле в потрясающем фильме-сенсации «I Believe I can Fly»

Погибший Танкред Меле в потрясающем фильме-сенсации «I Believe I can Fly» National Geographic 2015. Вокруг света: лучшие фото от путешественников

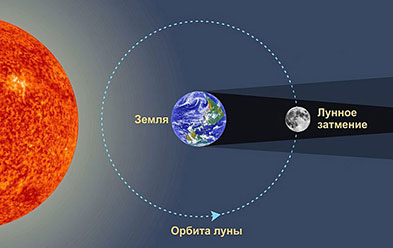

National Geographic 2015. Вокруг света: лучшие фото от путешественников 16 фото. 10 декабря 2011 - Полное затмение Луны

16 фото. 10 декабря 2011 - Полное затмение Луны 17 фотографий конкурса «Путешественник». National Geographic 2012

17 фотографий конкурса «Путешественник». National Geographic 2012 Нереально конечно! Лучшие высококлассные HD фотографии космоса за 2015

Нереально конечно! Лучшие высококлассные HD фотографии космоса за 2015 Хит в Instagram: 40 тысяч км по Австралии и масса отличных фотоснимков

Хит в Instagram: 40 тысяч км по Австралии и масса отличных фотоснимков Экстрим. Человек-паук Ален Робер - покоритель небоскребов

Экстрим. Человек-паук Ален Робер - покоритель небоскребов National Geographic 2016: фото с впечатляющим и разнообразным миром природы

National Geographic 2016: фото с впечатляющим и разнообразным миром природы Фотосъемка птиц в дикой природе: великолепие финских сов

Фотосъемка птиц в дикой природе: великолепие финских сов Самые яркие кадры и лучшие эмоциональные фото 2015 года - 1

Самые яркие кадры и лучшие эмоциональные фото 2015 года - 1

Глобальная слежка в Windows 10: как запретить сбор данных?

Глобальная слежка в Windows 10: как запретить сбор данных? Проблемы экологии. Покажите фильм «Дом. История путешествия» всем людям!

Проблемы экологии. Покажите фильм «Дом. История путешествия» всем людям! Заставим Windows 10 прекратить нарушать приватность пользователей!

Заставим Windows 10 прекратить нарушать приватность пользователей! Долг платежом красен! Кому же США должны рекордные 20 трлн долларов?

Долг платежом красен! Кому же США должны рекордные 20 трлн долларов? Сравниваем! Обсуждение почасовой минимальной зарплаты в разных странах

Сравниваем! Обсуждение почасовой минимальной зарплаты в разных странах Редкие таинственные дикие кошки. Вы даже не знали о существовании таких!

Редкие таинственные дикие кошки. Вы даже не знали о существовании таких! Спящие мужья - ведь шоппинг для жены может продолжаться вечность

Спящие мужья - ведь шоппинг для жены может продолжаться вечность Словно живые: цветные фото советских героев Великой Отечественной войны

Словно живые: цветные фото советских героев Великой Отечественной войны Сливочный фрукт авокадо: как его выбрать и приготовить?

Сливочный фрукт авокадо: как его выбрать и приготовить? Вы бы стали есть овощные консервы из колонии строгого режима?

Вы бы стали есть овощные консервы из колонии строгого режима? Рецепты с фото: теплый салат с фасолью, картофелем и тунцом

Рецепты с фото: теплый салат с фасолью, картофелем и тунцом Пальмовое масло сегодня - одно из самых потребляемых в мире

Пальмовое масло сегодня - одно из самых потребляемых в мире Блюда из овощей - наилучшие рецепты из вкусных кабачков

Блюда из овощей - наилучшие рецепты из вкусных кабачков Приготовь! Шоколадные рецепты: вкуснейший торт «Прага»

Приготовь! Шоколадные рецепты: вкуснейший торт «Прага» Рецепт морских гребешков с фуа-гра, ягодами и острым медовым соусом

Рецепт морских гребешков с фуа-гра, ягодами и острым медовым соусом Здоровая еда: полезные для человека растительные масла

Здоровая еда: полезные для человека растительные масла